The present study came about based on a dual observation.

On the one hand, the proven existence of low-cost (or even almost free) strategies where geographic extensions (ccTLDs) such as .TK (Tokelau), .ML (Mali) etc. are concerned, and on the other hand, the observation of very similar strategies in new extensions such as .XYZ, famous for having shot up from 0 to 6 million domain names registered in just two years, before settling at just over 2 million today. The ‘cost’ in the latter case was just 1 cent – similar to the almost free-of-charge approach observed with certain ccTLDs.

This type of strategy is fairly familiar, with high volumes of creations resulting from the low price combined after one year with high volumes of deletions, either because renewal rates are much higher than creation rates or because holders who have registered large numbers of ‘almost-free’ names have not achieved their goals (sales or monetisation of traffic) and let them lapse when they’ve expired.

We thought it would be interesting to use the extensive ‘laboratory’ that nTLDs represent to attempt to numerically identify the typology of these low-cost extensions, which are primarily found among ‘generic’ nTLDs as opposed to community, geographic and brand extensions.

In order to do this, we selected a number of generic nTLDs that had been on the market for at least three years (2016 and earlier) so as to avoid the ‘side effects’ associated with the opening phases, which usually see high creation rates(1) combined with relatively low maintenance rates(2), as much as possible. This approach excludes, for example, the .ICU extension, which saw very large numbers of creations in 2019, though it is unclear what proportion of these names will be retained in 2020. It also excludes .BRAND domain names that follow specific dynamics.

The usual life cycle of an extension would see its creation rate decrease as stock increased and the maintenance rate increase in relation to how long ago the name had been registered. These values will stabilise after a certain time, provided that no isolated incidents (promotional campaigns, domaining waves, etc.) occur to disrupt them.

But what relevant thresholds are used to describe the situation of a given extension? A quantitative analysis performed on all Legacy and nTLDs that met our criteria (launched prior to 31/12/16) enabled us to determine the following thresholds, which we consider to be the most relevant.

a) Maintenance rate

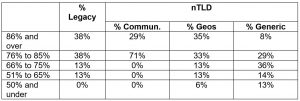

Breakdown of generic TLDs (Legacy and nTLDs) by maintenance rate

16 Legacy TLDs were taken into account (with the exception of .POST and .MUSEUM domain names, which were recently ‘relaunched’ by AFNIC), 7 community nTLDs, 48 geographic nTLDs (.ALSACE, etc.) and 424 generic nTLDs.

The thresholds were consistent with what we had already observed with ccTLDs (country code Top Level Domains). The maintenance rate for the .FR extension – a long-established extension in its market -, for example, is between 81% and 83%, varying from time to time.

Above the 86% threshold we find TLDs with a high proportion of used and/or defensive names that are renewed on a regular basis and registries whose policies are not to delete anything.

The extensions within the 76% to 85% bracket are well established within their respective fields of activity, with high usage and holder ‘loyalty’ rates.

Between the 66% and 75% thresholds, TLDs tend to struggle to stabilise their holder base, but this stage often simply represents the transition to the upper category, which explains the low proportion of TLDs in this case.

The same is true of TLDs in the 51% to 65% bracket, though the situation is a little more severe in this case, generally resulting from dynamic marketing strategies focusing on new creations to the detriment of building loyalty (the .PL (Poland) ccTLD is an example of such a scenario).

Finally, beneath the 50% renewal threshold, there are a small proportion of TLDs that may either be experiencing major setbacks by simply losing customers or have implemented very aggressive marketing strategies that have ultimately resulted in significant deletions. Our low-cost offering should, in theory, fall into the latter category.

That said, a TLD’s position within a particular category could be considered favourable, perfectly normal or a matter of concern depending on its age. As such, the 13% of Legacy TLDs with maintenance rates of less than 66% are in a potentially more serious situation than the 36% of generic nTLDs that fall into the same category, which are still new and held by holders that are more volatile than those of older TLDs.

b) Creation rate

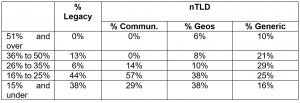

Breakdown of generic TLDs (Legacy and nTLDs) by creation rate

The most dynamic extensions in this table have a high creation rate, whilst those extensions attracting the fewest new creations have a low creation rate.

The ‘normal’ value (cruising speed) could be considered to fall into the 16% to 25% bracket, with the 15% and under category concerning extensions that are at risk of suffocation due to a lack of sufficient demand.

Creation rates of over 51%, however, mean that more than 1 name in 2 has been registered over the course of the past 12 months in a given portfolio and on a given date. This rate is typical of a classic scenario in the two years following a market launch and is highly indicative of aggressive promotional strategies if sustained for over 3 years.

The other two categories (26% to 35% and 36% to 50%) include extensions that have implemented successful marketing campaigns and/or are still new enough to have a significant proportion of newly created names in their portfolio.

c) But what about low-cost nTLDs?

The hypothesis on which our research was based was that these low-cost extensions would be among those with a very high creation rate (51% and over) combined with a very low maintenance rate (50% and under).

Where these two criteria intersect we find 25 generic nTLDs, i.e. 6% of the 424 included in the study. Yet these 6% of nTLDs account for 61% of the domain names registered under generic nTLDs in terms of volume (14.5 million in June 2019, i.e. almost 50% of all nTLDs).

This implies that around 30% (61% x 50%) of the names registered as nTLDs are expected to disappear over the course of the coming year, not to mention deletions in other categories. This simple calculation highlights one of the reasons behind the persistent volatility of nTLDs, which can vary by several million in either direction in the space of just a few months. The reality is that these significant variations are determined by just a handful of extensions, which our study has allowed us to isolate.

Our approach has been validated by the list of 25 nTLDs identified (based on ICANN data from June 2019), including the .XYZ, .TOP, .SITE and .CLUB extensions, which are among the Top 10 nTLDs and are known for adopting low-cost approaches (without necessarily going as far as being almost free of charge).

- .BUSINESS

- .CLUB

- .GDN

- .HOST

- .INK

- .KIM

- .LIFE

- .LTD

- .ONLINE

- .PRESS

- .REALTY

- .RED

- .SERVICES

- .SHOP

- .SITE

- .SPACE

- .STORE

- .TECH

- .TOP

- .WEBCAM

- .WEBSITE

- .WEDDING

- .WORK

- xn--6qq986b3xl .我爱你

- .XYZ

This ranking is clearly not static as it evolves according to the strategies adopted by the players concerned and the natural constraints imposed by both the market and the life cycle of domain names. This being the case, a growing extension will see its stock increase and will naturally find it increasingly difficult to maintain a constant rate of creation. Likewise, an increasing maintenance rate for an extension that is achieving zero growth or even in decline can only reflect the fact that there are very few new creations and that the stock is based increasingly on names that have been used and/or defensively registered in the past. It’s all about balance and the context in which the TLD is operated.

We searched for .WANG – one of the low-cost extensions used in 2017-2018 – for example, and found that it currently (as of June 2019) has a creation rate of 19% and a maintenance rate of 31%. This is an interesting case of withdrawing from a low-cost strategy whereby creations become less common and renewals continue to suffer from the volatility of registrations made whilst the low-cost strategy was still in force, leading to a significant purge in stock (-62% between June 2018 and June 2019). These data are expected to change over the coming years, with the rate of creation worth being maintained by the registry whilst the maintenance rate will gradually improve.

The main issue for new registries often relates to the volume of names managed, which, where third parties (and indeed investors!) are concerned, is indicative of an extension’s success. After a few years, however, these same registries realise that the true key to success is the profitability of their activity. The change in strategy can prove to be a sensitive matter, in terms of both accounts and relations with registrars. To paraphrase an ironic critique of the effects of the austerity policies advocated by the IMF, it is better for a TLD to have fewer but profitable names than to potentially ‘die a millionaire’.

(1) Creation rate: total number of creations over the last 12 months/stock

(2) Maintenance rate: (stock – creations over the last 12 months)/stock 12 months earlier